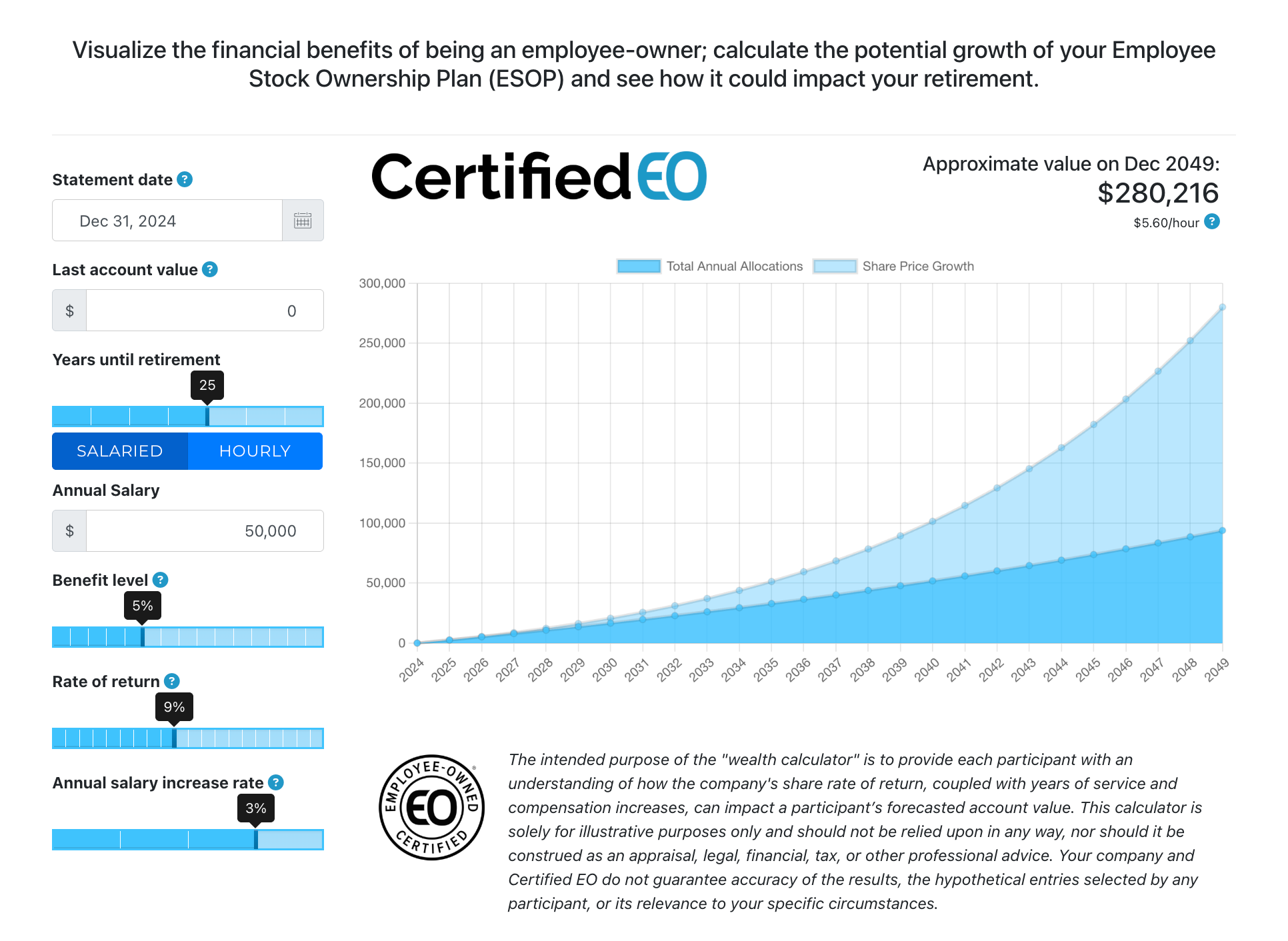

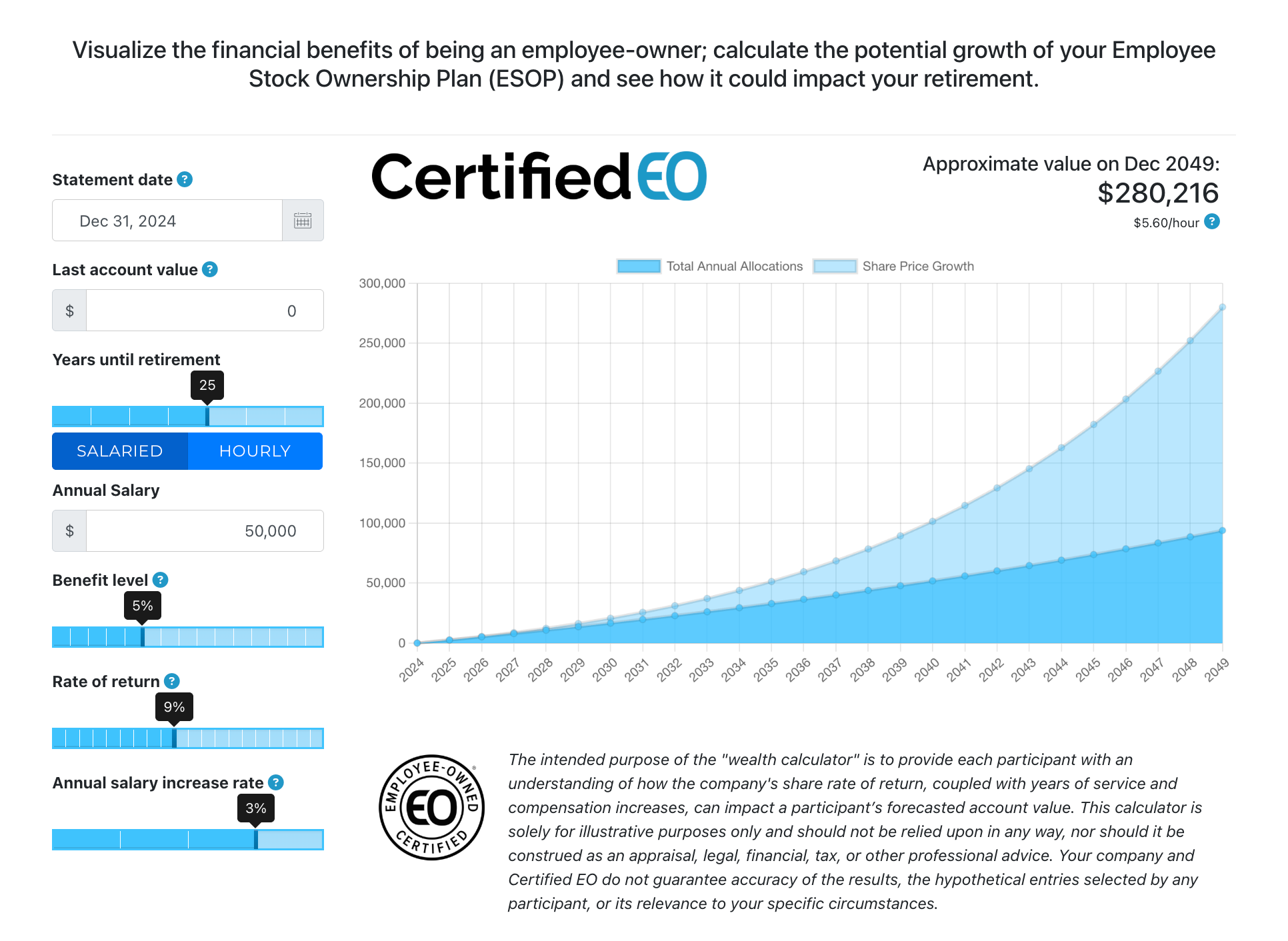

Member-Exclusive Wealth Calculator

Our wealth calculator is a member-exclusive illustrative tool to help communicate the possibilities of your EO benefit. To learn more, schedule a call.

Schedule a Call

Our wealth calculator is a member-exclusive illustrative tool to help communicate the possibilities of your EO benefit. To learn more, schedule a call.

Schedule a Call